It's easy to say. Get covered: when sickness strikes and you don't have health insurance, physical or financial ruin is likely to follow.

But everybody knows that. And knowing it doesn't change the fact that health insurance is notoriously expensive.

According to a report by a trade organization called America's Health Insurance Plans, the average annual health insurance premium for single adults ages 18-24 was $1,429 in 2009.

Compound that with the tens of thousands of dollars many students have to pay in tuition and/or room and board fees, as well as the costs of textbooks, food and everyday life, and it can be tempting to pocket the $125 or more a month that would pay for a premium.

But tempting fate rarely turns out well, and being without health insurance when tragedy strikes could mean losing the financial means to stay in school.

That's one of the reasons Valerie Lyon, an administrator at Cornell University and the chair of the American College Health Association's Student Health Insurance/Benefits Plans coalition, says it's essential that all students have health insurance.

She pointed out that while forgoing health insurance might save money for a while, disaster can strike at any time. What's more, everyday medical needs or simple problems can turn into major financial burdens when healthcare costs aren't mitigated by insurance coverage.

"I think people don't really pay attention until something happens and then they wish they had made their decision differently," Lyon said.

It's not enough just to buy health insurance - we have to buy good health insurance coverage that will fit within our means and cover our specific needs. Taking the time to shop for plans and sort through the fine print of often confusing policies can be well worth it in the end, and will feel especially wise in the moment when we're faced with out-of-pocket costs and finding out our pockets aren't as deep as we'd planned.

In looking for health insurance plans, we should be hesitant to sign up for so-called "young invincible" insurance options. These plans prey on our youthful health (and our faith in it) and offer low premiums but very high deductibles.

Lyon said plans like these cover catastrophic healthcare costs - such as prolonged hospitalization - but leave students hanging when comes to the less dangerous but still expensive stuff: having prescriptions filled or even getting stitches.

Young invincible coverage can end up costing as much or as more as it initially helps users save, which is one reason it's a good idea to consider what could happen in the future with your health before buying a plan.

"If the plan on the surface looks really cheap, it probably is really cheap in the benefits that it offers," Lyon said. "Really look at the details of the plan. What is the plan going to pay for the premium dollars that you're spending? You really want to look for high value for your dollars."

No matter what else is pressing on your budget, you have to prepare for the worst.

All it takes is one missed stop sign, one persistent virus or - heaven forbid - one mysterious lump. Faced with tens of thousands of dollars or more in hospital bills, that few hundred you were saving for textbooks won't matter much.

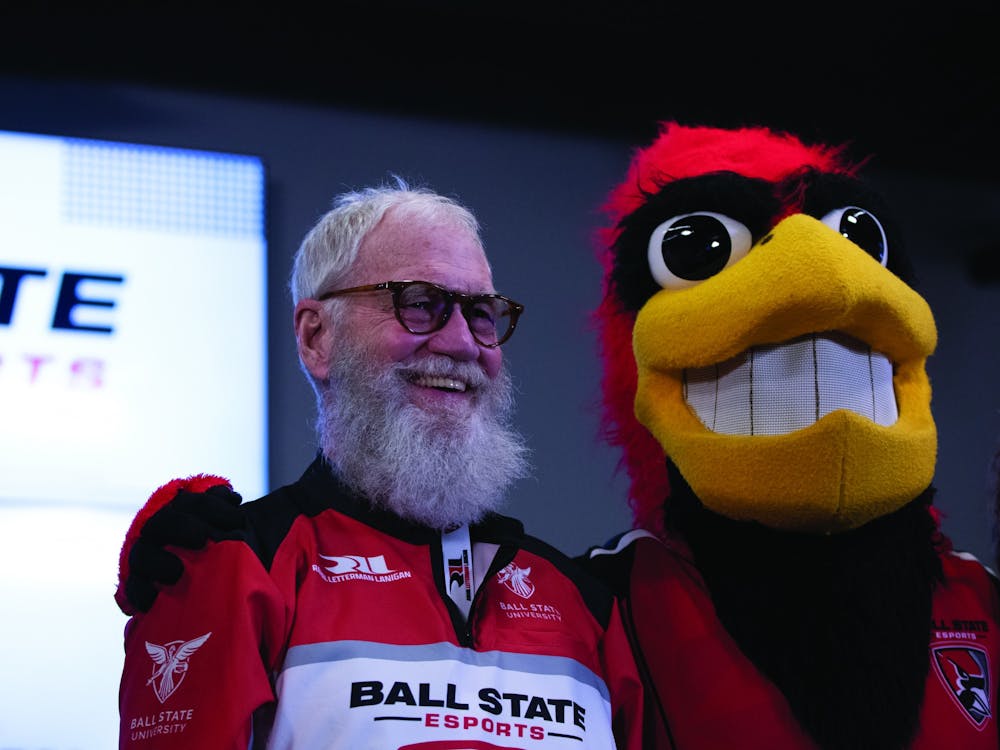

Victoria Ison is a Ball State University freshman majoring in magazine journalism and Spanish.