Glue-covered hands work away on a colorful project on construction paper. Small untied shoes pitter patter across the classroom. Markers and crayons roll onto the desks of each student.

As a fourth-year elementary education major at Ball State University, Margaret Stein is finally ready to graduate and start her career.

One of the basic building blocks of teaching is constructing your classroom, and while Stein is excited to begin right away, inflation is adding to an already pressurized time.

It’s widely known teachers don’t make a lot of money, Stein said, and with everything getting more expensive, she’s scared.

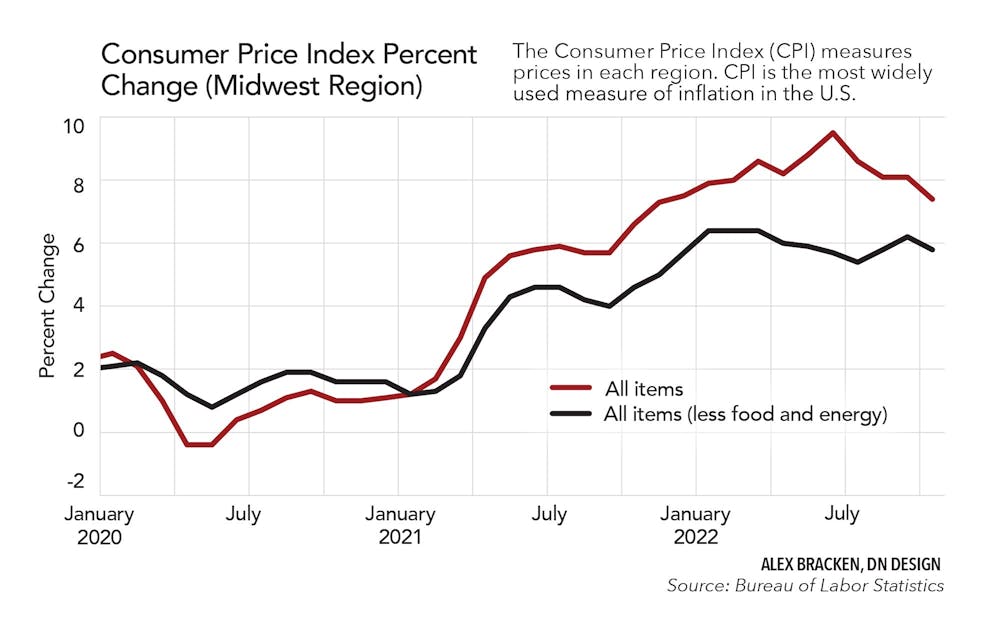

According to the International Monetary Fund, inflation measures the expense rate a set of goods has increased over a certain period of time. As of September, according to the Organization for Economic Co-operation and Development, inflation in most countries rose 10.5 percent in a year. According to the U.S. Bureau of Labor Statistics in June, this was the largest increase of inflation in 40 years, and at the time, it had only gone up by nine percent. As of October, the inflation percentage in the U.S. decreased to 7.7 percent.

Erik Nesson, associate economics professor and department chair at Ball State, said inflation isn’t always bad, and economists find small amounts desirable for economic growth. Too much can hurt consumers.

“It is really painful for people whose incomes cannot adjust along with the prices,” Nesson said. “So if prices go up by five percent, and your income goes up by five percent, then you're at the same place where you started, but that is not how a lot of jobs work.”

According to Education Week, the National Education Association showed the average salary of a teacher increased 1.7 percent from 2021, not enough to keep up with inflation.

“Regardless of whether you buy a house … or to rent, that now costs a lot more than it did before,” Nesson said. “That also holds true for just the broader basket of goods that people have to buy. Food, energy, travel: all of those things are certainly more expensive.”

When the prices of necessary items start to increase but the amount of money one is able to spend stays the same, Nesson said a lot of people have to start making tough decisions on how much of their income they can spend.

“Rent as a whole is always something that I'm concerned about,” Stein said. “Overall, just paying bills and insurance and keeping track of it all is definitely concerning.”

Stein doesn’t get paid for her student teaching, but since she is also a full-time student, there isn’t a lot of time for anything else.

“Keeping up with bills can definitely be intimidating, but we're making it work paycheck to paycheck, barely,” she said.

That’s a concern for some graduating seniors across the nation with inflation rates on the rise.

Stein said she has donated plasma many times and picked up small jobs to save up and prepare for life after college.

“I think that the graduation overall rate of success is unique to this year because we're coming towards this end of the [COVID-19] pandemic, and it’s truly not the end because we're obviously still being impacted every day,” she said. “... Financially, it's going to hit students really hard.”

Stein said Ball State has pushed out a couple grants to help students during the pandemic, but students still need more.

“I would say that Ball State definitely could have prepared me better,” she said. “I feel that they have done the very minimum, and that minimum level has prepared me to graduate and start, but once I'm about to start … there's an intimidation factor there. You know, my confidence isn't as high.”

Stein said Ball State did what they could though.

Ball State has the Career Center to help students with career questions and needs. To help students worried about financial needs, Ball State also has the Basic Needs Hub, a resource that helps with wellness, food security, housing support and unaccompanied homeless and foster youth. Ball State has emergency grants for those who are struggling with expenses.

One of Stein’s biggest financial concerns is the cost of her classroom. She said it can cost a couple thousand dollars from her pocket.

“Ball State has charged a lot for tuition, and I've paid a lot in room and board and taken a lot that way,” Stein said. “... Now I'm expected to start up this additional funding that you didn't really expect was going to happen.”

According to Adopt a Classroom, on average, it costs teachers $750 to buy their school supplies, with 30 percent of teachers spending over $1,000. This data is from July 2021 though, and in that year, the price of school supplies has increased by nearly 15 percent, according to the Associated Press.

“So with … inflation increasing as much as it is, I've seen my pay rate stay at the exact same level, and things are only going up,” Stein said. “… It's very intimidating, but at the same time, you know, I think it starts us off on a good foot to hopefully start seeing a pay raise for teachers.”

Nesson has a similar concern.

“At Ball State, our salaries go up, usually pretty slowly, so my raises have not kept up with inflation,” he said. “Fortunately for us, we live very close to campus, so we don't have to drive very much, but we've noticed the cost of a lot of our groceries is going up quite a bit … It's a lot more expensive than it was before, so we definitely notice prices going up as I'm sure most consumers do as well.”

Ben Yoder, Ball State alumnus and music teacher for Hamilton Southeastern Schools, has also been affected by growing inflation rates.

“I believe raising the federal minimum wage is something that should've been done a while ago, as it hasn't been keeping up with rising costs of living for quite some time now,” he said. “Regardless of the level of inflation we are dealing with, I think the minimum wage should keep up with the general cost of living, which it has not.”

Nesson said often when prices go up, consumers want higher wages, then this becomes a cycle called a wage price spiral. This back and forth can be bad for the economy and cause unemployment, which can then lead to an economic recession.

According to the Reserve Bank of Australia, a recession is “a sustained period of weak or negative growth in real GDP, or output, that is accompanied by a significant rise in the unemployment rate.” Just after Yoder graduated, he went through the 2008 financial crash. He said this caused a recession and led to a decline in revenue for both education and the state.

“If there's a recession, then employment opportunities for students might not be as abundant as they were before, and that's obviously a huge concern for people who are coming out of college and looking to find a job,” Nesson said.

He said students should try to control the decisions they can right now by looking at starting salaries and employment prospects. For those who aren’t graduating soon, Nesson said it’s an important factor that should be considered when choosing a major.

Contact Lila Fierek with comments at lkfierek@bsu.edu or on Twitter @fierek_lila.